Featured PublicationS

Report of the High-Level Commission

on Carbon Prices

The High-Level Commission, which was convened by the Carbon Pricing Leadership Coalition and supported by the Government of France and the World Bank, brought together 13 leading economists from nine developed and developing countries to identify the range of carbon prices which would help deliver on the core goal of the Paris Agreement. The Commission, co-chaired by Nobel Laureate Joseph Stiglitz and Lord Nicholas Stern, concluded that a carbon price of $40-$80 per ton of CO2 equivalent by 2020, rising to $50-$100 per ton by 2030, when combined with supportive policies, would allow for the achievement of the Paris goal.

Technical Note: Simulating Carbon Markets

Worldwide, interest in carbon pricing and ETSs as key options for ambitious climate action is increasing and important lessons can be learned from their implementation in different context. In countries new considering an ETS, however, simulations can be a useful tool to assist both policymakers and businesses to prepare for emissions trading.

Download the technical note

Executive Brief: Distributional impacts of carbon pricing on households

While carbon pricing policies aim to shift behavior towards low-carbon alternatives, they can also result in unintended distributional effects for households, especially when lower-cost alternatives are not available. The negative distributional impacts can be offset through specific policy design choices, but efforts to do so should not undermine the goal of incentivizing emissions reduction.

Download the executive brief

Report of the High-Level Commission on Carbon Pricing and Competitiveness

This report showcases dialogue among business leaders to explore the evidence base, the concerns of business, and the lessons learned in the design and implementation of carbon pricing policies in the context of competitiveness.

Download report and key findings

The Economic Potential of Article 6 of the Paris Agreement and Implementation Challenges

This report produced an assessment of the economic potential of Article 6, and the possible implications of the various design options being negotiated. The study was carried out by the International Emissions Trading Association and co-sponsored by Carbon Pricing Leadership Coalition,with the help of researchers and modellers from the University of Maryland.

Download the report and the summary

International Research Conference

This report provides a summary of the discussions at the first International Research Conference on Carbon Pricing held from February 14-15, 2019 in New Delhi, India.

With the goal of strengthening the carbon pricing knowledge base and fostering an improved understanding of the evolving challenges to its successful application, the Carbon Pricing Leadership Coalition convened researchers, practitioners, and interested stakeholders for the CPLC Research Conference.

Download report

Over 30 researchers from across the globe presented papers on various carbon pricing themes. This report provides the papers that were selected and the proceedings of the conference.

Download working paper report

Using Carbon Revenues

As carbon pricing is increasingly recognized as an important source of government revenue, this report provides practical guidance on using carbon revenues by helping policymakers understand the implications, opportunities, and challenges associated with different approaches to carbon revenue use. The report presents examples from many jurisdictions and discusses how carbon revenues can be crucial in supporting cost-effective climate mitigation, industrial competitiveness and other economic and development objectives. It also discusses how the way carbon revenues are used and the way these uses are communicated influence public and stakeholder acceptability of carbon pricing.

Download report and case studies

CPLC Publications and Resources

The CPLC drives action through knowledge sharing and targeted technical analysis tailored for policy makers, business leaders and practitioners on current and emerging practices related to the design and implementation of carbon pricing initiatives, market trends, opportunities and trade-offs.

To see a full listing of CPLC publications, click the image to the left. For additional knowledge products on carbon pricing from both the Coalition and our partners, scroll down.

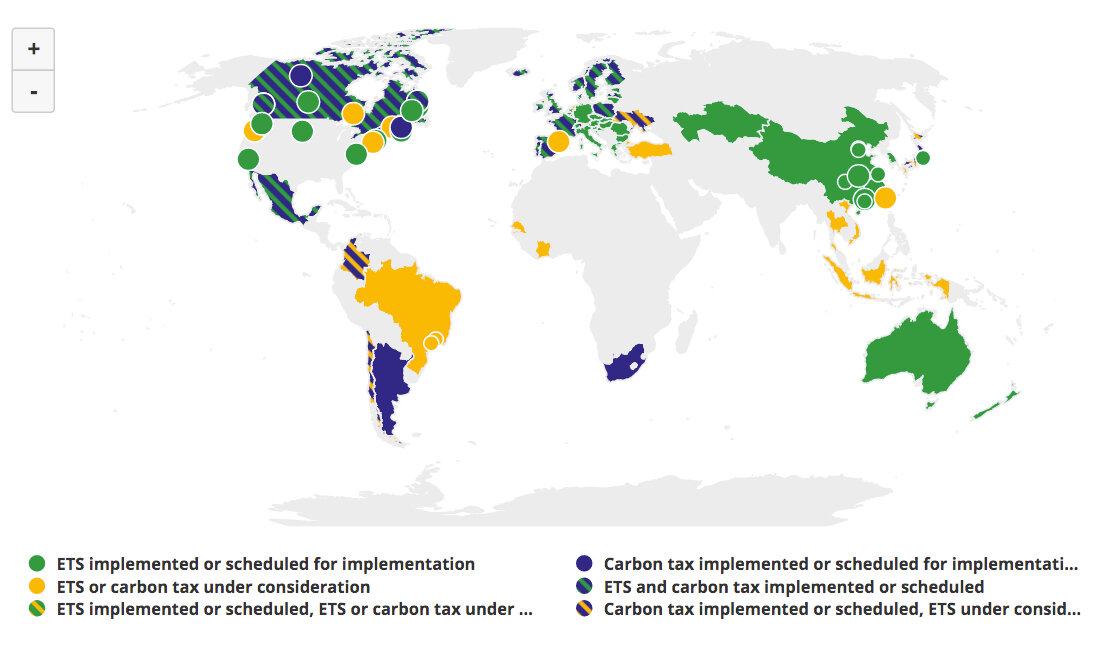

Carbon Pricing Dashboard

Launched in May 2017, the Carbon Pricing Dashboard is an interactive online platform that provides up-to-date information on existing and emerging carbon pricing initiatives around the world. It builds on the data and analyses of the annual State and Trends of Carbon Pricing report series.

Users can navigate key statistics and information on carbon initiatives implemented or scheduled for implementation using interactive mapping.

The Carbon Pricing Dashboard was developed by the World Bank Group with the help of Navigant and ICAP and, is supported by CPLC.

LIBRARY

Competitiveness and Carbon Leakage

How can consumption-based carbon pricing address carbon leakage and competitiveness concerns? (CPLC, 2018)

What is the Impact of Carbon Pricing on Competitiveness?

Japanese, Spanish version (Carbon Pricing Leadership Coalition, 2016)

Carbon pricing, Competitiveness and Carbon Leakage: theory, evidence and policy design

(World Bank, 2015)

Impacts of Carbon Prices on Indicators of Competitiveness: A Review of Empirical Findings

(OECD, 2015)

Carbon Pricing & Addressing Competitiveness

(IETA, 2015)

Environment and trade: Do stricter environmental policies hurt export competitiveness?

(OECD, 2016)

Empirical Evidence on the Effects of Environmental Policy Stringency on Productivity Growth

(OECD, 2014)

Use of Revenues

Using Carbon Revenues (PMR, 2019)

Carbon pricing across the world: how to efficiently spend growing revenues? (I4CE, 2018)

What are the Options for Using Carbon-Pricing Revenues

Japanese Spanish version (Carbon Pricing Leadership Coalition, 2016)

The Investment of RGGI Proceeds through 2014 Regional Greenhouse Gas Initiative (RGGI, 2016)

Carbon pricing: how best to use the revenue?

(Grantham Institute, GGGI, 2015)

Two World Views on Carbon Revenues

(Resources for the Future, 2013)

Carbon Fee and Dividend Explained (Citizens Climate Lobby, 2016)

Better Growth Better Climate, 2016

(New Climate Economy, 2014)

How to Use Carbon Tax Revenues

(Tax Policy Center, 2016)

Choose Wisely: Options and Trade-Offs in Recycling Carbon Pricing Revenue

(Canada Eco-Fiscal Commission)

British Columbia’s Revenue-Neutral Carbon Tax: A Review of the Latest “Grand Experiment"

(Nicholas Institute and University of Ottawa Institute of the Environment, 2015)

Recycling carbon revenues: Transforming costs into opportunities

(I4CE, 2016)

Carbon Pricing Revenues

(CMIA, 2015)

Carbon Pricing in the Maritime Shipping Sector

Carbon pricing options for international maritime emissions (New Climate Institute, 2019)

Understanding the Economic Impacts of Greenhouse Gas Mitigation Policies on Shipping: What is the State of the Art of Current Modeling Approaches? (World Bank, 2019)

Regional carbon pricing for international maritime transport (World Bank, 2018)

Policy Alignment

Carbon Pricing Assessment and Decision-Making: A guide to adopting a carbon price (Partnership for Market Readiness, 2021)

A Guide to Developing Domestic Carbon Crediting Mechanisms (Partnership for Market Readiness, 2021)

How can Carbon Prices and Policies be effectively aligned? Spanish version (Carbon Pricing Leadership Coalition, 2016)

Climate and Carbon: Aligning prices and Policies

(OECD, 2013)

Aligning Policies for a Low-carbon Economy

(OECD/IEA/NEA/ITF, 2015)

The FASTER Principles for Successful Carbon Pricing: An approach based on initial experience. (Spanish vers.)

(OECD/World Bank Group, 2015)

STATE AND TRENDS OF CARBON PRICING

State and Trends of Carbon Pricing 2021 (World Bank, 2021)

State and Trends of Carbon Pricing 2020 (World Bank, 2020)

State and Trends of Carbon Pricing 2019 (World Bank, 2019)

State and Trends of Carbon Pricing 2018 (World Bank, 2018)

Carbon Pricing Watch 2017 (World Bank, Ecofys, May 2017)

State and Trends of Carbon Pricing 2016 (World Bank, Ecofys, 2016)

Business &

Carbon Pricing

Greening Construction: The Role of Carbon Pricing: Briefing Note (IFC/CPLC, 2019)

Greening Construction: The Role of Carbon Pricing (IFC/CPLC, 2019)

Construction Industry Value Chain: How Companies Are Using Carbon Pricing to Address Climate Risk and Find New Opportunities (IFC/CPLC, 2018)

Carbon Pricing in Brazilian Industry: a strategic initiative, English version (CPLC/cebds, 2018)

Carbon Pricing in Brazilian Industry: a strategic initiative, Portuguese version, (CPLC/cebds, 2018)

Carbon Pricing and the Task Force on Climate-related Financial Disclosures (CPLC, 2018)

Reducing Risk, Addressing Climate Change Through Internal Carbon Pricing: A Primer for Indian Business (WRI, 2018)

The Role of Carbon Pricing in a Low-Carbon Transition (Report from the Canadian Business Members of CPLC to Minister McKenna and Coalition partners, 2018)

C-Suite guide to internal carbon pricing Toolbox for creating corporate value (Ecofys, The Generation Foundation and CDP, 2017)

How-to guide to corporate internal carbon pricing - Four dimensions to best practice approaches (Ecofys, The Generation Foundation and CDP, 2017)

Internal Carbon Pricing – Stress Testing Business for Climate Change Risk (Talking Points brief from Trucost, a division of S&P Global, 2017)

Putting a Price on Carbon: Integrating Climate Risk into Business Planning 2017 (CDP)

Putting a Price on Carbon:

A Handbook for Indian Companies (CDP, TERI, 2017)

Carbon Pricing Corridors (CDP, 2017)

Impacts Of A Global Carbon Price On Consumption And Value Creation

Implications For Carbon Pricing Design (Generation Foundation, Ecofys, NTU, Netherlands Environmental Assessment Agency)

Valuation of Energy Costs in the Indian Context: A Survey Based Study of Select Indian Corporates (TERI)

A Win-Win Solution to Abate Aviation CO2 Emissions (Joint Program on the Science and Policy of Global Change, MIT, 2017)

Three notes on the management of climate-related risks by financial actors (I4CE, 2017)

Carbon Market Readiness Training Guide (IETA, B-PMR, 2017)

Internal Carbon Pricing, A Growing Corporate Practice (English and French, EpE, I4CE, 2016)

Carbon Pricing: what the business sector needs to know to position itself (CEBDS and CDP, 2016)

Embedding a Carbon Price Into Business Strategy (CDP, 2016)

Executive Guide to Carbon Pricing Leadership

(UN Global Compact, WRI, 2015)

Putting a price on risk: Carbon pricing in the corporate world

(CDP, 2015)

Emerging Practices in Internal Carbon Pricing

(WBCSD, 2016)

Investing in a Time of Climate Change

(Mercer, 2015)

Corporate Use of Carbon Prices: Commentary from Corporations, Investors and Thought Leaders

(CDP, 2014)

Preparing for Carbon Pricing: Case Studies from Company Experience - Royal Dutch Shell, Rio Tinto, and Pacific Gas and Electric Company

(Partnership for Market Readiness, 2015)

Climate Action and Profitability: CDP S&P 500 Climate Change Report 2014

(CDP, 2014)

Markets Matter: Greenhouse Gas Markets 2014

(IETA, 2014)

Caring for Climate Business Leadership Criteria on Carbon Pricing

(UN Global Compact, 2014)

Linking carbon markets

Emissions Trading in Practice, Second Edition: A handbook on design and implementation (Partnership for Market Readiness, ICAP, 2021)

The Economic Potential of Article 6 of the Paris Agreement and Implementation Challenges (CPLC, IETA, 2019)

Instead of a Global Carbon Tax (ICC Sweden, 2019)

Moving Towards Next Generation Carbon Markets: Observations From Article 6 Pilots (Climate Finance Innovators, 2019)

A Guide to Linking Emissions Trading Systems (ICAP, 2018)

Towards global carbon pricing: direct and indirect linking of carbon markets

(OECD, 2014)

Carbon Market Clubs and the New Paris Regime

(Climate Strategies, 2016)

Towards a global price on carbon: Pathways for linking carbon pricing instruments

(Adelphi, 2015)

Networking Carbon Markets – Key Elements of the Process

(World Bank, 2016)

Toward a club of carbon markets

(EDF, 2015)

Creating a club of carbon markets: Implications of the trade system

(ICTSD, WEF, 2015)

Addressing Climate Change: A WTO Exception to Incorporate Climate Clubs

(ICTSD, WEF, 2015)

Lessons Learned from Linking Emissions Trading Systems: General Principles and Applications

(World Bank, 2014)

Towards A Global Carbon Market Prospects for Linking the EU ETS to Other Carbon Markets

(Carbon Market Watch, 2015)

Linking Emissions Trading System: A Summary of Current Research

(ICAP, 2015)

Options and Issues for Restricted Linking of Emissions Trading Systems

(ICAP, 2015)

OTHER

Carbon Pricing, Climate Change, and Air Quality (2019)

Report of the High-Level Commission on Carbon Pricing and Competitiveness (CPLC, 2019)

International Research Conference (CPLC, 2019)

Carbon Mechanisms Review: Accelerating Action (Germany, 2019)

Unlocking Africa’s Carbon Market (Germany, 2019)

Fiscal Policies for Paris Climate Strategies—from Principle to Practice (IMF, 2019)

Guide to Communicating Carbon Pricing (CPLC, PMR, 2018)

Guide to Communicating Carbon Pricing Briefing Note: Business (CPLC, PMR, 2018)

Guide to Communicating Carbon Pricing Briefing Note: Government (CPLC, PMR, 2018)

Carbon Pricing Trends (© OECD, 2018)

Internal Carbon Pricing in Higher Education Toolkit (Working Group on Carbon Pricing in Higher Education, 2018)

Why Carbon Pricing Matters: A guide for Implementation (WBCSD 2018)

Carbon Pricing Corridors report: the market view 2018 (CDP, 2018)

Carbon Pricing in Practice: A Review of the Evidence 2017 (The Center for International Environment & Resource Policy)

Global Panorama of Carbon Prices in 2017 (I4CE)

Public Willingness To Pay for a U.S. Carbon Tax and Preferences for Spending the Revenue (Yale University)

China Carbon Market Watch 2017 (PMR)

Report of the High-Level Commission on Carbon Prices (CPLC)

Carbon Pricing Watch 2017 (World Bank and Ecofys)

ETS News from China, Q1 2017 English, 2016 Q4 in Chinese ,PMR)

The Sustainable Infrastructure Imperative: Financing for Better Growth and Development. (The New Climate Economy , 2016)

Galvanising low-carbon innovation (The New Climate Economy , 2016)

Underwriting 1.5°C: competitive approaches to financing accelerated

climate change mitigation (Perspectives Climate Group GmbH, 2017)

Ensuring Additionality under Art. 6 of the Paris Agreement: Suggestions for modalities and procedures for crediting of mitigation under Art 6.2 and 6.4 and public finance provision under Art. 6 (Perspectives Climate Research, 2017)

Market Mechanisms and the Paris Agreement (Harvard Project on Climate Agreements, 2017)

Writing the Paris Rulebook: Principles and Guardrails to Keep Things in Check (Carbon Mechanisms Review, September - October 2017, Issue 3)

BACKGROUND NOTES

This Executive Briefing discusses the progress being made in reducing greenhouse gas (GHG) emissions, challenges to achieving effective GHG emissions reduction, and the key role that financiers can play in both mitigating their own risks and helping the industry towards a more orderly, effective decarbonization.

Background Note: Carbon Pricing Readiness

As countries construct their 2030, 2040, and 2050 greenhouse gas mitigation scenarios, they have increasingly identified cost-efficient policies, including carbon pricing instruments, as essential elements of proposed climate action. Countries’ activities in this regard differ based on their unique circumstances, and range from improving “carbon pricing readiness” to designing and piloting various carbon pricing instruments. This note provides updates on countries' activities.

Background Note: Corporate Action for Putting a Price on Carbon

Companies in a diverse range of sectors see carbon pricing as the most efficient and cost-effective means of tackling the climate challenge. Many companies are voicing support for government action to put a price on carbon. Many also assign a price on carbon internally.

An ETS is an explicit carbon pricing instrument that limits or caps the allowed amount of greenhouse gas emissions and lets market forces disclose the carbon price through emitters trading emissions allowances.

Emissions Trading 101 Library

(IETA, 2015)